Having reached almost three quarters of 2017, I thought it was time to pen down the performance of the IH Investment Portfolio (aka my wealth fund). I currently squirrel away 50% of my monthly income, and part of that goes into building up my financial nut (as how Financial Samurai aptly describes his wealth fund).

Performance since Jan 2017

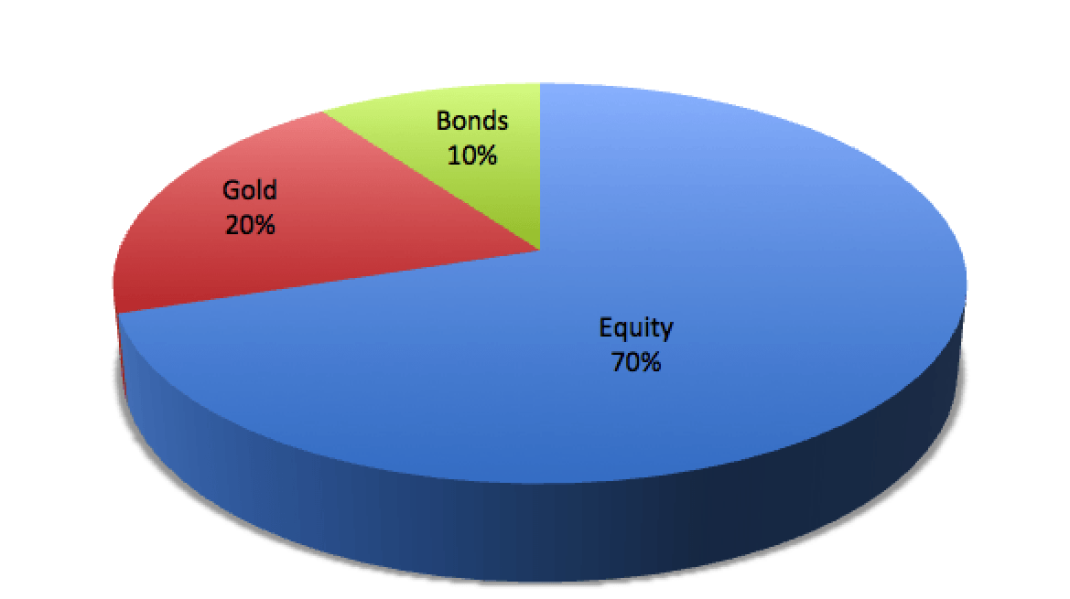

IH Portfolio Ideal Allocation

IH Portfolio Ideal Allocation

I strongly believe in risk-taking as long as I’m still below 35 years of age. Hence, my ideal portfolio allocation would be 70% on risk asset classes and 30% on less risky asset classes. To be more specific, I will work towards owning Equities in 70% of my portfolio, 20% in Gold and 10% in Bonds.

The current portfolio at current market valuations (August 2017) consists of 47% in equities, 31% in Gold and 21% in Bonds.

IH Portfolio Ideal Allocation

I will be gradually adding to my Equity Positions quarterly to reach my ideal portfolio allocation, and re-balance once at the end of the year.

Performance of portfolio is currently enjoying gains of 1.71%, versus the gains of S&P 7.37%. I’m not too worried at the moment, because if the S&P rallies further, the higher weightage of equities will cause my portfolio to enjoy further gains, while any dips in the S&P will allow buying opportunities for me.

I’ll do a semi-annual review of the IH portfolio to let everyone stay updated on its performance!